This post is sponsored by YNAB

So…how much does it really cost to renovate a kitchen you ask? Today, I want to break it down for you so that you can see what is possible for you for your kitchen, and how to afford it. The first thing to realize is that kitchens can be anywhere from hundreds of dollars all the way up to hundreds of thousands of dollars, but the best kitchen reno is the one that is in YOUR home and done in a way that YOU love and that YOU can afford.

So…what goes into a kitchen reno? And how much does it REALLY cost?

Picture a kitchen reno like a build-your-own sundae…

You get to pick and choose which parts you want (the ice cream, bananas, sauce, sprinkles…). You don’t HAVE to take everything, you can just choose the parts that are most important to you. BUT, everything you add on adds to the total cost.

I am going to break this down into the most simple kitchen ice cream sundae basics. haha!

CABINETS

In my kitchen, I am refacing my cabinets with Nieu Cabinets. Which means, I kept my cabinet boxes and got NEW door fronts to update the look of my cabinets. I also removed and moved around some of the boxes for a slightly new layout. I am not an expert in total gut job kitchens, so I will focus on refacing costs but I do know that typically refacing instead of a full gut of the kitchen is up to 60% less than the cost of a new kitchen.

Here are the average costs for REFACING a kitchen:

The GALLEY KITCHEN (21.5 linear feet)

starting at $1,263

The U-SHAPED Kitchen (30 linear feet)

starting at $1,725

The L-SHAPED Kitchen (40 linear feet)

starting at $2,300

MY KITCHEN: In my kitchen, I needed doors for an entire pantry wall as well as the rest of the kitchen, so it was a lot larger order than the average kitchen. The total for the doors ended up at $4,682.

*my doors are the Angela Rose Slim Shaker in Dream Dusk (code ANGELAROSEHOME5 for 5% off order)

Remember, these costs can always go up if you decide to add in new side panels, new drawers, new hinges etc. Also remember, the cost changes if you DO IT YOURSELF or if you hire someone to install for you! I did mine myself so I had no additional cost there.

COUNTERTOPS

You can keep your countertops, or you can change them! If you get new countertops, here are some very basic numbers for you. (Remember these vary a ton per state, store, slab etc…but here is a basic idea from the experts I talked to)

The average kitchen uses 2 stone slabs (and sometimes 3) for new countertops.

When you get new countertops, the cost includes the following:

SLAB (the stone) + FABRICATION (building the countertop) + INSTALLATION (putting the countertops in

Slabs cost anywhere on average from $500-$2000 (but can be higher)

Fabrication PLUS Install per slab is on average around $2000 (but depends on a lot of factors).

This means for an average kitchen of 2 slabs… the cost could look something like:

$1,500 per slab x 2=$3,000

PLUS $2,000 fab/install x 2=$4,000

TOTAL $7,000

MY KITCHEN:

Each marble slab $1,500 (I got 3)

Fabrication PLUS Installation per slab $2,000

APPLIANCES

You guys, this one feels silly to even talk about. You can keep your appliances for ZERO cost, or buy crazy expensive appliances and spend $50,000. You do you, okay? The best kitchen reno is one that YOU can afford and that YOU love.

MY KITCHEN:

I purchased my dacor 42 in panel-ready counter depth fridge, and worked with Smeg for the double range and panel-ready dishwasher. My hood insert was $800, and the wood and materials to finish it were less than $100.

EXTRAS

Don’t forget about the extras, they can add up! But, like our ice cream sundae…you get to choose where to splurge and where to save.

- hardware (you can spray paint your own, get affordable option, or do nicer hardware. I ordered mine from here)

- lighting

- soft close hinges

- furniture/stools

Now that you have an idea of what you can afford…how do you plan and save for a kitchen reno?

*check out this before and after

I promise that a kitchen reno IS possible, and that it can even be fun to save up for it. I have been in charge of the budgeting for my family for 16 years and my favorite budgeting app I use is YNAB- You Need A Budget. It helped me gain control of my money, make my goals a reality and doesn’t feel restrictive at all like other budgeting programs. Using this app makes me feel so much less stress about my money and makes me feel in charge.

I promise you’ll love it!

They gave me a link so you can try it for 34 days FREE.

Here is how you save for a reno…

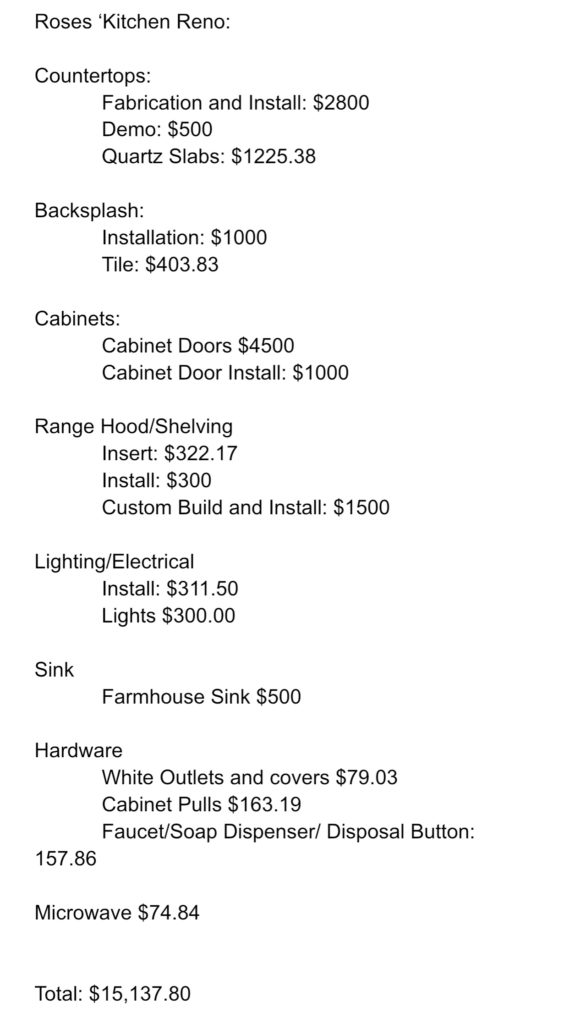

*to demonstrate, I asked my sister-in-law who has also used YNAB how she recently saved for her $15,000 kitchen reno.

BEFORE

AND AFTER

Set up a Category in your budget for KITCHEN RENO, set a GOAL amount, and every month ADD to it.

example: my sister-in-law set up a “KITCHEN RENO” folder. Every month she put in around $300. In the months where they had some extra money, they also placed the extra month in the “KITCHEN RENO” folder.

After 2 years, she had $300 x 24= $7,200 saved up monthly

PLUS she added extra bonuses and money from categories where she spent less than anticipated.

$15,000 kitchen reno

The YNAB Budgeting Method (YNAB’s 4 rules)

*I love these, and it’s totally changed the way I think about my money.

1. Give Every Dollar a Job. (this is my favorite rule!) Know exactly how you want to spend the money you have available- and only the money you have right now – before you spend a dime. This helps insure that you have money for the things that matter most for you. Think of your money as working for you and don’t let it sit a round idle!

*To me it kinda feels like cashing out a paycheck, and having envelopes for different categories (rent, utlities, food, vacation), and then putting the money into the different envelopes…right when you cash it.

2. Embrace Your True Expenses. Figure out what you really spend…like REALLY…and treat those infrequent expenses (like twice a year car insurance) like monthly expenses in your monthly budget. Breaking big or uncommon expenses down means you won’t be surprised by them!

3. Roll with the Punches. Accept that things change and your budget needs to be flexible. You won’t spend the same amount on all categories every month, so be prepared to move money around. Moving money around doesn’t mean you are budgeting wrong, it means you are actually budgeting!

4. Age your Money. Break the paycheck to paycheck cycle by aiming to reach the point of using the money you earned last month to pay this month’s expenses. This margin will create more peace of mind than you can even imagine.

I hope this gives you a good starting point and was a little bit helpful! You got this!

To try YNAB FREE for 34 days, click this link.